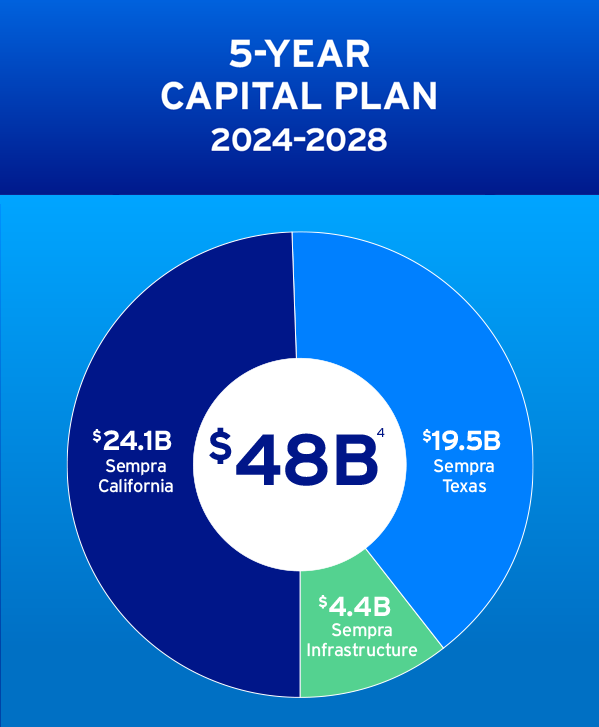

“It’s an exciting time for our company,” said Sempra Chairman and CEO Jeffrey W. Martin on CNBC’s “Mad Money with Jim Cramer” on Feb. 29 following the 2023 full-year earnings call where Martin announced a company-record $48 billion five-year capital plan and reaffirmed the company’s projected long-term EPS growth rate of 6% to 8%1.

Capital plan

Martin shared with Cramer that a portfolio of strong growth opportunities prompted the 20% increase to the company’s five-year capital plan2. The capital plan largely focuses on Sempra California and Sempra Texas, two of Sempra’s three growth platforms.

Martin shared with Cramer that a portfolio of strong growth opportunities prompted the 20% increase to the company’s five-year capital plan2. The capital plan largely focuses on Sempra California and Sempra Texas, two of Sempra’s three growth platforms.

“We increased our capital plan by roughly $8 billion and that will allow us to fund several strategic initiatives — grid modernization, as well as key investments in safety and reliability. Plus, we’ll be making additional grid investments to bring renewables online at a faster pace,” Martin said.

Corporate strategy

Over time, American companies that have demonstrated sustained, long-term success have also demonstrated an adept approach to continuing to invest in and optimize their corporate strategy, Martin said. Since its founding 25 years ago, this has been a hallmark of Sempra’s success.

“We have long talked about the importance of strategy,” Martin said. “We view it as an opportunity to organize our assets, employees and investments to create a competitive advantage in the marketplace.”

Over the last six years, the company has steadily focused on building leadership positions in large economic markets like California and Texas while narrowing its investment focus to the transmission and distribution (T&D) portion of the energy value chain.

“In combination, these two features of our strategy have positioned our company to grow cash flows and earnings at an attractive rate with less exposure to commodity and other related risks,” Martin said.

Market update

“We remain excited about new opportunities in the state of California,” Martin said.

With the state committed to being a clean energy leader, the company is taking active steps to “green the grid” and make investments in safety and reliability for the benefit of its customers. At Sempra California’s San Diego Gas & Electric, the company is a national leader in its support for renewables, including rooftop solar where San Diego County has an impressive 23 percent penetration rate. The company is also making investments to support electric vehicle (EV) penetration in the San Diego region, which is home to roughly 140,000 EVs.

Martin also detailed the company’s efforts in Texas, which center on the need to expand and modernize the electric grid to help support projected economic expansion and continued population growth. In addition to these regulated T&D investments, the company has also launched a $13 billion3 construction project to build a new liquefied natural gas (LNG) export project in Port Arthur, TX. Responding to the unique opportunity set in Texas, Martin said, “We certainly believe we will be among the largest capital investors in the State of Texas through the end of the decade.”

American leadership

Cramer showed a lot of interest in the size and scale of Sempra’s growth story in LNG and the Department of Energy’s (DoE) recent pause in permitting new export projects.

“Today, the United States is the global leader in LNG,” Martin said. “Going forward, we expect that will continue because the long-term fundamentals of LNG are intact due to continued strong demand from Europe and Asia and the need to back out coal as a feedstock for power production.”

Martin went on to confirm that Port Arthur LNG Phase 1 and ECA LNG Phase 1 are fully permitted and well into the construction phase and that several other development projects already have the required DoE permits. He concluded by saying, “The United States is a force for good in the global energy markets.”

Martin also indicated that he expects the permitting issue at DoE to be temporary, and that America would continue to be a global leader in both the energy markets and in sustainable business practices.

“At Sempra, we believe those two things can co-exist together,” Martin said. “More importantly, if we do our job, the real winner will be the American worker and America’s allies who will use LNG to improve energy security and achieve a lower carbon footprint.”

1 Refers to Sempra’s 2024 – 2028 capital plan which includes $16.2B of Sempra’s proportionate ownership interest in projected capital expenditures at unconsolidated entities while excluding Sempra’s projected capital contributions to those entities, and excludes $8.6B of noncontrolling interest’s proportionate ownership interest in projected capital expenditures at Sempra and at unconsolidated entities. Sempra’s capital plan and expectations regarding potential increases to its capital requirements are based on a number of assumptions, the failure of which to be accurate could materially impact Sempra’s actual capital expenditures.

2 Refers to the increase from Sempra’s 2023 – 2027 capital plan to its 2024 – 2028 capital plan.

3 Refers to projected capital expenditures, which represent 100% of the project, not Sempra’s ownership share. Capital expenditures include capitalized interest at the project level and project contingency.

4 Refers to the increase from Sempra’s 2023 – 2027 capital plan to its 2024 – 2028 capital plan which includes $16.2B of Sempra’s proportionate ownership interest in projected capital expenditures at unconsolidated entities while excluding Sempra’s projected capital contributions to those entities, and excludes $8.6B of noncontrolling interest’s proportionate ownership interest in projected capital expenditures at Sempra and at unconsolidated entities. Sempra's capital plan and expectations regarding potential increases to its capital requirements are based on a number of assumptions, the failure of which to be accurate could materially impact Sempra's actual capital expenditures.

This article contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on assumptions about the future, involve risks and uncertainties, and are not guarantees. Future results may differ materially from those expressed or implied in any forward-looking statement. These forward-looking statements represent our estimates and assumptions only as of the date of this press release. We assume no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise.

In this article, forward-looking statements can be identified by words such as "believe," "expect," "intend," "anticipate," "contemplate," "plan," "estimate," "project," "forecast," "envision," "should," "could," "would," "will," "confident," "may," "can," "potential," "possible," "proposed," "in process," "construct," "develop," "opportunity," "preliminary," "initiative," "target," "outlook," "optimistic," "poised," "maintain," "continue," "progress," "advance," "goal," "aim," "commit," or similar expressions, or when we discuss our guidance, priorities, strategy, goals, vision, mission, opportunities, projections, intentions or expectations.

Factors, among others, that could cause actual results and events to differ materially from those expressed or implied in any forward-looking statement include: California wildfires, including potential liability for damages regardless of fault and any inability to recover all or a substantial portion of costs from insurance, the wildfire fund established by California Assembly Bill 1054, rates from customers or a combination thereof; decisions, investigations, inquiries, regulations, denials or revocations of permits, consents, approvals or other authorizations, renewals of franchises, and other actions, including the failure to honor contracts and commitments, by the (i) California Public Utilities Commission (CPUC), Comisión Reguladora de Energía, U.S. Department of Energy, U.S. Federal Energy Regulatory Commission, Public Utility Commission of Texas, U.S. Internal Revenue Service and other regulatory bodies and (ii) U.S., Mexico and states, counties, cities and other jurisdictions therein and in other countries where we do business; the success of business development efforts, construction projects, acquisitions, divestitures, and other significant transactions, including risks related to (i) being able to make a final investment decision, (ii) completing construction projects or other transactions on schedule and budget, (iii) realizing anticipated benefits from any of these efforts if completed, (iv) obtaining third-party consents and approvals, and (v) third parties honoring their contracts and commitments; macroeconomic trends or other factors that could change our capital expenditure plans and their potential impact on rate base or other growth; litigation, arbitrations, property disputes and other proceedings, and changes to laws and regulations, including those related to tax and trade policy and the energy industry in Mexico; cybersecurity threats, including by state and state-sponsored actors, of ransomware or other attacks on our systems or the systems of third parties with which we conduct business, including the energy grid or other energy infrastructure; the availability, uses, sufficiency, and cost of capital resources and our ability to borrow money or otherwise raise capital on favorable terms and meet our obligations, including due to (i) actions by credit rating agencies to downgrade our credit ratings or place those ratings on negative outlook, (ii) instability in the capital markets, or (iii) rising interest rates and inflation; the impact on affordability of San Diego Gas & Electric Company’s (SDG&E) and Southern California Gas Company’s (SoCalGas) customer rates and their cost of capital and on SDG&E’s, SoCalGas’ and Sempra Infrastructure’s ability to pass through higher costs to customers due to (i) volatility in inflation, interest rates and commodity prices, (ii) with respect to SDG&E’s and SoCalGas’ businesses, the cost of meeting the demand for lower carbon and reliable energy in California, and (iii) with respect to Sempra Infrastructure’s business, volatility in foreign currency exchange rates; the impact of climate and sustainability policies, laws, rules, regulations, disclosures and trends, including actions to reduce or eliminate reliance on natural gas, increased uncertainty in the political or regulatory environment for California natural gas distribution companies, the risk of nonrecovery for stranded assets, and uncertainty related to relevant emerging and early-stage technologies; weather, natural disasters, pandemics, accidents, equipment failures, explosions, terrorism, information system outages or other events, such as work stoppages, that disrupt our operations, damage our facilities or systems, cause the release of harmful materials or fires or subject us to liability for damages, fines and penalties, some of which may not be recoverable through regulatory mechanisms or insurance or may impact our ability to obtain satisfactory levels of affordable insurance; the availability of electric power, natural gas and natural gas storage capacity, including disruptions caused by failures in the transmission grid, pipeline system or limitations on the withdrawal of natural gas from storage facilities; Oncor Electric Delivery Company LLC’s (Oncor) ability to reduce or eliminate its quarterly dividends due to regulatory and governance requirements and commitments, including by actions of Oncor’s independent directors or a minority member director; and other uncertainties, some of which are difficult to predict and beyond our control.

These risks and uncertainties are further discussed in the reports that Sempra has filed with the U.S. Securities and Exchange Commission (SEC). These reports are available through the EDGAR system free-of-charge on the SEC’s website, sec.gov, and on Sempra’s website, sempra.com. Investors should not rely unduly on any forward-looking statements.

Sempra Infrastructure, Sempra Infrastructure Partners, Sempra Texas, Sempra Texas Utilities, Oncor and Infraestructura Energética Nova, S.A.P.I. de C.V. (IEnova) are not the same companies as the California utilities, SDG&E or SoCalGas, and Sempra Infrastructure, Sempra Infrastructure Partners, Sempra Texas, Sempra Texas Utilities, Oncor and IEnova are not regulated by the CPUC.