Setting insight into motion

Dear fellow shareholders:

In 2023, we celebrated Sempra’s 25th anniversary, marking decades of energy service to millions of families and businesses.

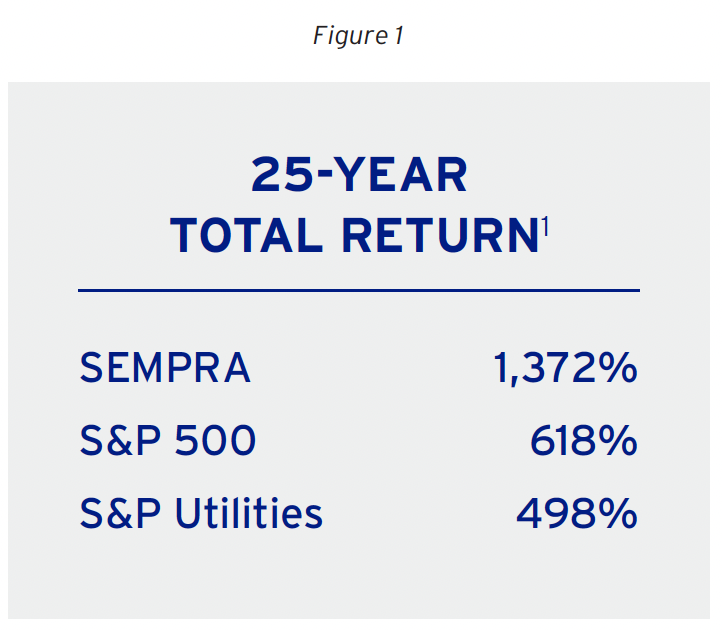

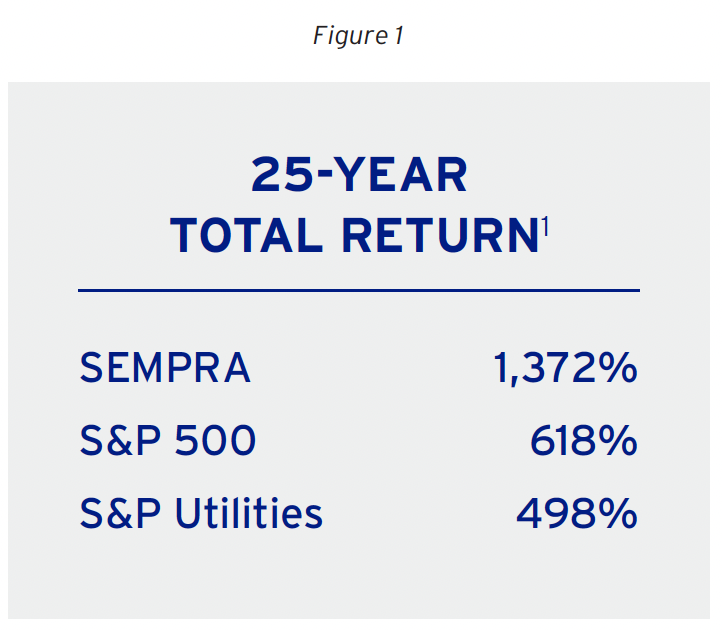

While our journey together began in earnest in 1998 with the merger of two Southern California utilities, along the way we have been successful in building our capabilities and adding scale to our businesses, while also earning a national reputation as a leader in sustainable business practices. Importantly, our corporate journey also includes a history of delivering outsized total returns to you, our shareholders (Fig. 1).

Along this journey, we adopted a corporate mission to build North America’s premier energy infrastructure company. This is our chosen path for value creation. It informs our strategy and how we organize our assets, develop our employees and determine investments to create a sustainable advantage in the market. In execution, we are intent on building leadership positions in some of the largest economic markets in North America and narrowing our focus within the energy value chain to the energy grid, where our investments can benefit from recurring cash flows and less exposure to commodities and related risks.

In 2023, we celebrated Sempra’s 25th anniversary, marking decades of energy service to millions of families and businesses.

While our journey together began in earnest in 1998 with the merger of two Southern California utilities, along the way we have been successful in building our capabilities and adding scale to our businesses, while also earning a national reputation as a leader in sustainable business practices. Importantly, our corporate journey also includes a history of delivering outsized total returns to you, our shareholders (Fig. 1).

Along this journey, we adopted a corporate mission to build North America’s premier energy infrastructure company. This is our chosen path for value creation. It informs our strategy and how we organize our assets, develop our employees and determine investments to create a sustainable advantage in the market. In execution, we are intent on building leadership positions in some of the largest economic markets in North America and narrowing our focus within the energy value chain to the energy grid, where our investments can benefit from recurring cash flows and less exposure to commodities and related risks.

Delivering Results

Sempra’s mission-led approach to strategy helped the company deliver a series of record financial results in 2023 (see Fig. 2 for select results). Moreover, we recently announced a company record $48 billion capital plan to guide our investment strategy through 2028. 2

This planned level of spending is important because energy infrastructure has never been more relevant — or more needed — to advance global prosperity and wellbeing. It is the combination of our clear strategy and differentiated leadership position that fuels our confidence in our company’s future. With deep appreciation of your trust, expectations and investment in our company, I am pleased to provide this year’s update on our progress.

Figure 2

2023 revenue of $16.7 billion

2023 earnings of $3.03 billion or $4.79 per diluted share

Exceeded high-end of 2023 EPS and adjusted EPS guidance ranges 3

$50 billion rate base in 2023 4

Affirmed projected long-term EPS growth rate of 6-8% 5

14 consecutive years of dividend increases

$1.3 billion of common equity issued to support growing capital investment 6

Strength for the Future

In 2023, we continued to execute our corporate strategy — investing in energy networks that power some of the most significant economic markets in the world, including California, Texas and Mexico. Our strong execution together with disciplined capital management resulted in strengthened market positions, improved risk profile, enhanced quality of cash flows and greater visibility to future growth. Also, in 2023 we unlocked new enterprise capacity that is allowing us to leverage innovation and new technologies to better serve customers, while improving the affordability of our services. Achievements across Sempra’ three growth platforms include:

Sempra California

Serving roughly 25 million consumers, Sempra California’s dual-utility platform focuses on operating a reliable, safe and resilient grid while helping achieve California’s clean energy goals.

Grid resilience continues to be prioritized through the testing of several pilots of innovative technologies, including a vehicle-to-grid program and virtual power plant, which achieved over 25 successful pilot demonstrations in 2023. Also, our electric utility business was awarded an estimated $500 million of planned transmission projects to support reliability as part of the California Independent System Operator’s final 2022-2023 transmission plan.

In addition, our utilities continue to support the market demand for lower-carbon energy. In 2023, the U.S. Department of Energy (DOE) selected California’s Alliance for Renewable Clean Hydrogen Energy Systems, of which SoCalGas is a partner, for up to $1.2 billion in funding to develop a regional clean hydrogen hub in California. 7

Moreover, California’s energy market saw constructive regulatory outcomes from the California Public Utilities Commission. The cost of capital mechanism was triggered for both utilities, benefiting both customers and shareholders. The authorized capacity at the Aliso Canyon storage facility was increased by over 50%, in support of system reliability and increased renewable integration.

Lastly, a proposed decision in the general rate cases is scheduled for the second quarter of 2024, with rates retroactively effective to January 1, 2024.

Sempra Texas

Broad economic growth across industries and the service territory are driving new investment opportunities at Sempra Texas. In April 2023, the Public Utility Commission of Texas constructively resolved Oncor’s base rate review to support the delivery of safe, reliable and affordable electricity, while also acknowledging the company’s track record of prudent investments.

In summer 2023, the Electric Reliability Council of Texas saw 10 peak demand records set, with a peak 16% higher than the peak just five years ago. This demand increase is fueling significant growth and expansion of Oncor’s system. Nearly $1.6 billion of transmission projects were placed into service in 2023, including placement of over 40 major substations and over 30 major switching stations and approximately 390 circuit miles of new or upgraded high-voltage transmission lines. Also in 2023, there was a 25% increase in active generation and retail transmission interconnection requests compared to 2022. A growing capital plan of over $24 billion at Oncor will support new investments to improve system reliability and resiliency. 8

Texas remains one of the fastest growing markets in the U.S. with premise growth double the national average. State leadership recognizes the need for grid expansion and modernization to maintain reliability and deliver cleaner energy. In 2023, several constructive legislative and regulatory outcomes were achieved that are expected to support critical new infrastructure investments in the Texas market, while also improving the timeliness of capital recovery.

Sempra Infrastructure

In 2023, Sempra Infrastructure announced a positive final investment decision for the $13 billion initial phase of the Port Arthur LNG liquefaction project and commenced construction. This export facility is designed to deliver 13 million tonnes per annum of liquefied natural gas to global markets, helping decarbonize the power sector abroad and improve energy security for U.S. allies. Sempra Infrastructure Partners finalized its project-level ownership at 28%, estimating a $1.74 billion equity contribution.

Cameron LNG Phase 1 continues to be highly efficient, delivering excess production and achieving over 700 cargoes loaded since production began. The EnergÍa Costa Azul LNG Phase 1 project in Baja California, Mexico remains under construction, with commercial operations slated for summer 2025.

Global interest in lower-emissions fuels continues to create further opportunities. In August 2023, Sempra Infrastructure announced a non-binding agreement with Mitsubishi Corporation and a consortium comprised of leading Japanese gas utilities to participate in the evaluation of a proposed project in the U.S. Gulf Coast to produce e-natural gas, a carbon neutral synthetic gas produced from renewable hydrogen and recycled carbon dioxide. If successful, the project could be one of the first links of an international supply chain of liquefied e-natural gas.

Additionally, the DOE selected HyVelocity Gulf Coast Hydrogen Hub, of which Sempra Infrastructure is a partner, for up to $1.2 billion in funding to help advance a network of hydrogen producers, consumers and connective infrastructure while supporting the production, storage, delivery and end-use of hydrogen. 7

Looking Ahead

Our progress this year enhanced our capacity to scale our business to meet the ever-increasing global demand for energy infrastructure. According to the International Energy Agency (IEA), global electricity demand is expected to rise 3.4% annually over the next several years, driven by an improving economic outlook, ongoing electrification of the residential and transportation sectors, and notable expansion of energy-intensive industries such as data centers supporting artificial intelligence. Closer to home, the IEA is forecasting roughly $5 trillion to be invested in North America’s energy grids over the next several decades, which further validates our grid-focused strategy and the sustainable nature of our long-term investment opportunity.

At Sempra, we are forecasting a diverse, generational investment opportunity to strengthen and grow our ownership position in energy grids, including hardened and smarter networks, energy storage and microgrids along with innovative software and sensors for improved safety and operating performance. We expect these investments to better support economic growth while also addressing market demand for lower carbon sources of energy.

Financial strength is key to unlocking this opportunity. Sempra is committed to maintaining its strong balance sheet, mitigating debt cost impacts and maintaining the company’s investment grade credit, while prudently investing capital and growing utility rate base. From our vantage as one of North America’s leading energy infrastructure companies, we see a portfolio of new opportunities ahead and will remain committed to disciplined capital allocation to prioritize the return of capital to our owners in the form of a growing dividend and to support our new capital plan.

Values Driven

Sempra’s values — do the right thing, champion people, shape the future — serve as the North Star for our journey. Central to our performance is our more than 20,000 employees’ shared purpose around serving our stakeholders. Their enthusiasm and grit inspire our leadership team every day. Our enduring commitment to safety, along with our sharp focus on energy security, reliability and affordability, propel our progress. More broadly, our high-performance culture, including our stakeholder orientation and innovation mindset, is key to our company’s differentiated financial performance for our shareholders.

I extend my sincere gratitude to each of you for investing in our mission to be North America’s premier energy infrastructure company. Thank you for your confidence in our team. We will continue working hard every day to earn it.

Continuing the mission,

Jeffrey W. Martin

Chairman and CEO

About Sempra

By the numbers

By the numbers

Sempra is a leading North American energy infrastructure company focused on delivering energy to nearly 40 million consumers. As owner of one of the largest energy networks on the continent, Sempra is electrifying and improving the energy resilience of some of the world’s most significant economic markets, including California, Texas, Mexico and global energy markets. The company is recognized as a leader in sustainable business practices and for its high-performance culture focused on safety and operational excellence, as demonstrated by Sempra’s inclusion in the Dow Jones Sustainability Index North America and in The Wall Street Journal’s Best Managed Companies.

Growth Platforms

Sempra California

Sempra California is a dual-utility platform that provides safe, reliable and increasingly clean energy to roughly 25 million consumers in Southern and Central California. With a focus on grid resiliency, reducing emissions and integrating more renewable energy onto their networks, they are also supporting California’s goal of the companies getting five million electric vehicles on the road by 2030. California is known for advancing new technologies and innovation, a spirit embraced at our California utilities that are investing in research into hydrogen, battery storage, predictive technology and other tools designed to reduce the impact of severe weather events and support the state’s ambitious climate goals.

Sempra California

Sempra California is a dual-utility platform that provides safe, reliable and increasingly clean energy to roughly 25 million consumers in Southern and Central California. With a focus on grid resiliency, reducing emissions and integrating more renewable energy onto their networks, they are also supporting California’s goal of the companies getting five million electric vehicles on the road by 2030. California is known for advancing new technologies and innovation, a spirit embraced at our California utilities that are investing in research into hydrogen, battery storage, predictive technology and other tools designed to reduce the impact of severe weather events and support the state’s ambitious climate goals.

Sempra Texas

Sempra Texas includes Oncor, a regulated electric transmission and distribution utility headquartered in Dallas that delivers reliable electricity to a population of approximately 13 million Texans in the rapidly growing state. With more than 143,000 miles of transmission and distribution lines, Sempra Texas is the largest pure-play transmission and distribution platform in Texas, connecting communities across the state to Texas’ diverse energy supplies.

Sempra indirectly owns an 80.25% interest in Oncor

Sempra Texas

Sempra Texas includes Oncor, a regulated electric transmission and distribution utility headquartered in Dallas that delivers reliable electricity to a population of approximately 13 million Texans in the rapidly growing state. With more than 143,000 miles of transmission and distribution lines, Sempra Texas is the largest pure-play transmission and distribution platform in Texas, connecting communities across the state to Texas’ diverse energy supplies.

Sempra indirectly owns an 80.25% interest in Oncor

Sempra Infrastructure

Sempra Infrastructure, headquartered in Houston, is focused on delivering energy for a better world by developing, building, operating and investing in energy infrastructure, such as LNG, energy networks and low-carbon solutions that are expected to play a crucial role in the energy systems of the future. Through the combined strength of its assets in North America, Sempra Infrastructure is connecting customers across the globe to modern energy infrastructure to source and transport renewables and natural gas, while advancing carbon sequestration and clean hydrogen.

Sempra owns a 70% interest in Sempra Infrastructure Partners, which, together with its operating company subsidiaries, primarily makes up the Sempra Infrastructure platform

Sempra Infrastructure

Sempra Infrastructure, headquartered in Houston, is focused on delivering energy for a better world by developing, building, operating and investing in energy infrastructure, such as LNG, energy networks and low-carbon solutions that are expected to play a crucial role in the energy systems of the future. Through the combined strength of its assets in North America, Sempra Infrastructure is connecting customers across the globe to modern energy infrastructure to source and transport renewables and natural gas, while advancing carbon sequestration and clean hydrogen.

Sempra owns a 70% interest in Sempra Infrastructure Partners, which, together with its operating company subsidiaries, primarily makes up the Sempra Infrastructure platform

Financial Highlights

Comparative Total Returns

The above graph compares the percentage change in the cumulative total shareholder return on Sempra common stock for the 25-year period ended December 31, 2023, with the performance over the same period of the S&P 500 Index and the S&P 500 Utilities Index.

These returns were calculated assuming an initial investment of $100 in our common stock, the S&P 500 Index and the S&P 500 Utilities Index on December 31, 1998, and the reinvestment of all dividends.

Consolidated Data

| In millions, except per-share amounts | 2021 | 2022 | 2023 |

|---|---|---|---|

| (1) Adjusted Earnings and Adjusted Diluted Earnings Per Common Share are non-GAAP financial measures. GAAP means generally accepted accounting principles in the United States of America. See A-pages for an explanation and reconciliation of non-GAAP financial measures. | |||

| Revenues | $12,857 | $14,439 | $16,720 |

| Earnings | $1,254 | $2,094 | $3,030 |

| Adjusted Earnings(1) | $2,637 | $2,915 | $2,920 |

| Earnings Per Common Share | |||

| Basic | $2.01 | $3.32 | $4.81 |

| Diluted | $2.01 | $3.31 | $4.79 |

| Adjusted Diluted(1) | $4.21 | $4.61 | $4.61 |

| Diluted Weighted-Average Number of Common Shares Outstanding | 626.1 | 632.8 | 632.7 |

| Total Assets | $72,045 | $78,574 | $87,181 |

| Dividends Declared Per Common Share | $2.20 | $2.29 | $2.38 |

| Debt-to-Total Capitalization Ratio | 47% | 50% | 48% |

| Book Value Per Common Share | $39.59 | $41.72 | $44.00 |

- These figures compare the percentage change in the cumulative total shareholder return on Sempra common stock for the 25-year period ended December 31, 2023, with the performance over the same period of the S&P 500 Index and the S&P 500 Utilities Index. These returns were calculated assuming an initial investment of $100 in our common stock, the S&P 500 Index and the S&P 500 Utilities Index on December 31, 1998, and the reinvestment of all dividends.

- Refers to Sempra’s 2024 – 2028 capital plan which includes $16.2 billion of Sempra’s proportionate ownership interest in projected capital expenditures at unconsolidated entities while excluding Sempra’s projected capital contributions to those entities, and excludes $8.6 billion of noncontrolling interest’s proportionate ownership interest in projected capital expenditures at Sempra and at unconsolidated entities.

- Adjusted EPS guidance range is a non-GAAP financial measure. GAAP means generally accepted accounting principles in the United States of America. See A-pages for an explanation and reconciliation of non-GAAP financial measures. All share and per share information in this document reflects the two-for-one split of our common stock in the form of a 100% stock dividend that was distributed to shareholders on August 21, 2023.

- Sempra California rate base is the value of assets on which San Diego Gas & Electric Co. and Southern California Gas Co. (SoCalGas) are permitted to earn a specific rate of return in accordance with rules set by regulatory agencies and is calculated using a 13-month weighted-average, excluding construction work in progress, in accordance with California Public Utilities Commission methodology as adopted in rate-setting proceedings. Sempra Texas rate base includes 100% of Oncor Electric Delivery Company LLC (Oncor) and Sharyland Utilities, L.L.C. and represents total estimated invested capital, as adjusted in accordance with Public Utilities Commission of Texas (PUCT) rules, at the end of the previous calendar year.

- Based on midpoint of revised 2024 EPS guidance range.

- Includes net proceeds received from shares issued under exercise of overallotment option and net proceeds expected to be received through 2024 from assumed physical settlement of forward sale agreements.

- This award is preliminary and subject to change based on award negotiations between the grant recipient and DOE.

- Reflects 100% of Oncor’s 2024 – 2028 capital plan which excludes potential effects from system resiliency plans to be filed for approval by the PUCT.